How much earn to file income tax

Not everyone is required to file an income tax return each year. Generally, if your total income for the year doesn't exceed the standard deduction plus one exemption and you aren't a dependent to another taxpayer, then you don't need to file a federal tax return. The amount of income that you can earn before you are required to file a tax return also depends on the type of income, your age and your filing status. All taxpayers are eligible to claim a standard deduction, and if not the dependent of another taxpayer, then one exemption as well.

The standard tax deduction and exemption amounts are fixed by the government before the tax filing season and generally increase for inflation each year. Since your income that is equal to or less than the sum of the exemption and standard deduction is not taxable, the IRS doesn't require you to file a return in years your income doesn't exceed that sum.

When determining whether you need to file a return, you don't include tax-exempt income. If you are at least 65 years old and receive Social Security income during the year, you are subject to the same filing requirements as any other taxpayer. However, you can generally receive more income during the year than other taxpayers before having to file a tax return.

An exception is if you are married but file a separate tax return from your spouse who you lived with during the year. In this case, you must include your Social Security income when evaluating whether your gross income exceeds the standard deduction plus one exemption.

In addition, if the IRS requires you to pay tax on a portion of your Social Security income because your other income is too high, then you must include that taxable portion in your calculation as well, regardless of your filing or marital status. All taxpayers who are claimed as a dependent on someone's tax return are subject to different IRS filing requirements, regardless of whether they are children or adults.

There are years when you are not required to file a tax return but may want to. If you have federal taxes withheld from your paycheck, the only way you can receive a refund when excessive amounts are withheld is if you file a tax return. The IRS does not automatically issue refunds without a tax return being filed.

Get every deduction you deserve. TurboTax Deluxe searches more than tax deductions and credits so you get your maximum refund, guaranteed. Do I Have to File a Tax Return if I Don't Owe Tax?

When Does a Senior Citizen on Social Security Stop Filing Taxes? How to Find Out How Much You Owe in IRS Back Taxes.

What You Should Know. Who Needs to File an Income Tax Return? What Is the Minimum Monthly Payment for an IRS Installment Plan?

Last Chance to Claim Your Tax Refund. What Is the Difference Between AGI and MAGI on Your Taxes? Top Red Flags That Trigger an IRS Audit. Estimate your tax refund and avoid any surprises. Adjust your W-4 for a bigger refund or paycheck. Enter your annual expenses to estimate your tax savings. Learn who you can claim as a dependent on your tax return. Turn your charitable donations into big deductions. Get a personalized list of the tax documents you'll need. Find out what you're eligible to claim on your tax return.

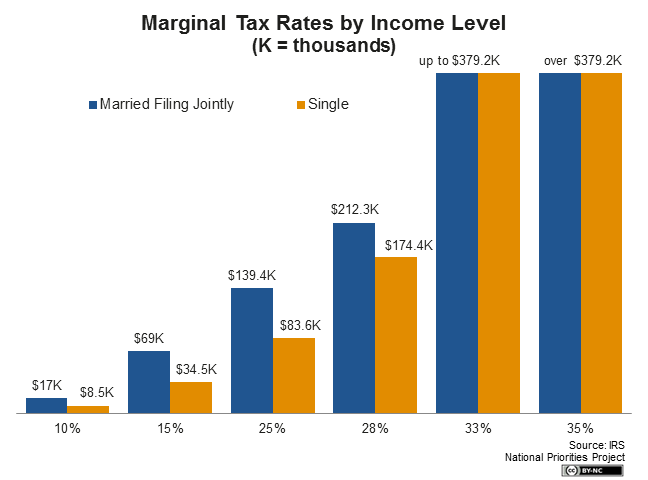

Find your tax bracket to make better financial decisions. The above article is intended to provide generalized financial information designed to educate a broad segment how much earn to file income tax rune easy way to make money public; it does not give personalized tax, investment, legal, or other business and professional advice.

Site Map Affiliates and Partners Software and License Agreements Privacy Statements Security Security Certification of the TurboTax Online application has been performed by C-Level Security.

Trademark Notices About Intuit Search Intuit Jobs Press By accessing and using this page you agree to the Terms and Conditions. Skip To Main Content. Does Everyone Need to File an Income Tax Return? Updated for Tax Year OVERVIEW Not everyone is required to file an income tax return each year. Gross income thresholds All taxpayers are eligible apa hukumnya trading forex claim a standard deduction, and if not the dependent of another taxpayer, then one exemption as well.

Income thresholds for taxpayers 65 and older If you are at least 65 years old and receive Social Security income during the year, you are subject to the same filing requirements as any other taxpayer. Dependent tax filings All taxpayers who are claimed as a dependent on someone's tax return are subject to different IRS filing requirements, regardless of whether they are children or adults.

Claiming tax refunds There are years when you are not required to file a tax return but may want to. Get every deduction you deserve TurboTax Deluxe searches more than tax deductions and credits so you get your maximum refund, guaranteed. Looking for more information? Forex hartschaumplatte kaufen Articles Do I Have to File a Tax Return if I Don't Owe Tax?

How to How much earn to file income tax Out Volume analysis forex Much You Owe in IRS Back Taxes Taxable Income vs. What You Should Know Video: More in IRS Tax Return What Is the Minimum Monthly Payment for an IRS Installment Plan? Last Chance to Claim Your Tax Refund Do I Have to File a Tax Return if I Don't Owe Tax? Get more with these free tax calculators and money-finding tools.

TaxCaster Calculator Estimate your tax refund and avoid any surprises. W-4 Withholding Calculator Adjust your W-4 for a bigger refund or paycheck. Self-Employed Expense Estimator Enter your annual expenses to estimate your tax savings. Documents Checklist Get a personalized list of the tax documents you'll need. Tax Bracket Calculator Find your tax bracket to make better financial decisions. TurboTax online and mobile pricing is based on your tax situation and varies by product.

Actual prices are determined at the time of print or e-file and are subject to change without notice. Savings and price comparisons based on anticipated price increase expected in March. Special discount offers may not be valid for mobile in-app purchases. QuickBooks Self-Employed Offer with TurboTax Self-Employed: Sign in to QuickBooks Self-Employed via mobile app or at https: Offer valid only for new QuickBooks Self-Employed customers.

When you use TurboTax Self-Employed to file your taxes, you will have the option to renew your QuickBooks Self-Employed subscription. You may cancel your subscription at any time from within the QuickBooks Self-Employed billing section. Pays for itself TurboTax Self-Employed: Actual results will vary based on your tax situation.

Internet access required; standard message and data rates apply to download and use mobile app. Fastest tax refund with e-file and direct deposit; tax refund time frames will vary.

Pay for TurboTax out of your federal refund: Prices are subject to change without notice. TurboTax Expert Help, Tax Advice and SmartLook: Included with Deluxe, Premier and Self-Employed via phone or on-screen ; not included with Federal Free Edition but available for purchase with the Plus bundle.

How Much Do You Have To Make To File Taxes? | H&R Block®

SmartLook on-screen help is available on a PC, laptop or the TurboTax mobile app. TurboTax experts provide general advice, customer service and product help; tax advice provided only by credentialed CPAs, enrolled agents and tax attorneys. Feature availability varies by device.

How much do you have to earn to file taxes? | jyfyyuxy.web.fc2.com

State tax advice is free. Service, area of expertise, experience levels, hours of operation and availability vary, and are subject to restriction and change without notice. Terms and conditions may vary and are subject to change without notice. Based on aggregated sales data for all tax year TurboTax products. TurboTax Deluxe is our most popular product among TurboTax Online users with more complex tax situations. Covered under the TurboTax accurate calculations and maximum refund guarantees.

Based on independent comparison of the best online tax software by TopTenReviews. Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. Additional fees apply for e-filing state returns. E-file fees do not apply to New York state returns. Savings and price comparison based on anticipated price increase expected in March.

Prices subject to change without notice. XX Refund Processing Service fee applies to this payment method. This benefit is available with TurboTax Federal products except TurboTax Business. About our TurboTax Product Experts: Customer service and product support vary by time of year. About our credentialed tax experts: Service, experience levels, hours of operation and availability vary, and are subject to restriction and change without notice.

Not available for TurboTax Business customers. Imports financial data from participating companies.

Quicken and QuickBooks import not available with TurboTax installed on a Mac. Imports from Quicken and higher and QuickBooks Desktop and higher ; both Windows only. Quicken import not available for TurboTax Business.

Quicken products provided by Quicken Inc. Mobile Tax Apps Mobile Tax Apps All TurboTax mobile apps Official TurboTax mobile app TaxCaster refund estimator app ItsDeductible donation tracker app. Help and Support Help and Support TurboTax support Contact us TurboTax Advantage support Where's My Refund TurboTax Alexa Refund Skill Get started with TurboTax Refund Status Support Common Tax Topics After you file your taxes TurboTax Self-Employed Support Center.

Social Social TurboTax customer reviews TurboTax blog TurboTax social hub TurboTax invite-a-friend discount TurboTax tax parties TurboTax big game commercial.

How much do you have to make to file taxes? | jyfyyuxy.web.fc2.com

More Products from Intuit More Products from Intuit TurboTax Canada Mint personal finance Accounting software Payroll services Quickbooks Payments Professional tax software Professional accounting software Mint free credit score More from Intuit. TurboTax Facebook TurboTax Twitter TurboTax YouTube TurboTax Pinterest TurboTax Blog. Certified by nResult Security Certification of the TurboTax Online application has been performed by C-Level Security Reviewed by TRUSTe, Site Privacy Statement Authorized e-file Provider.