Role of sebi in regulating indian stock market

July 29, Author: Banking and Finance laws Total Views: They not only determine the level of activity in the securities market but also the level of activity in the economy. The growth in the numbers of investors in India is encouraging. The trends reveal that in addition to FIIs and Institutional Investors, small investors were also gradually beginning to regain the confidence in the capital markets that had been shaken consequent to the stock market scams during the past decade.

It is imperative for the healthy growth of the corporate sector that this confidence is maintained. Some of them may not be aware of the complete risk-return profile of the different investment options. Some investors may not be fully aware of the precautions they should take while dealing with market intermediaries and dealing in different securities. They may not be familiar with the market mechanism and the practices as well as their rights and obligations.

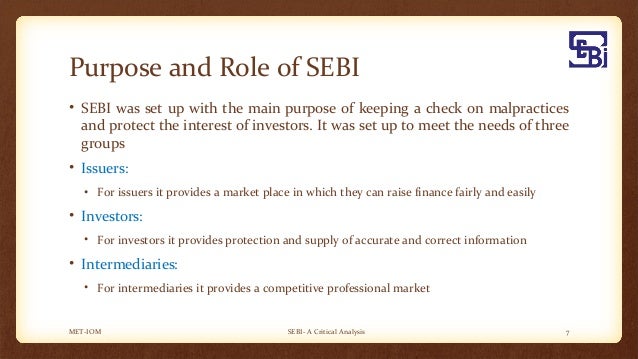

The corporate systems and processes need to be credible and transparent, so that the interests of the investors may be safeguarded in a manner that enables them to exercise their choice in an informed manner while making investment decisions, and also providing them with a fair exit option. The Securities and Exchange Board of India SEBI has been mandated to protect the interests of investors in securities and to promote the development and regulate the securities market so as to establish a dynamic and efficient Securities Market contributing to Indian Economy.

The concept of investor protection has to be looked at from different angles taking into account the requirements of various kinds of investors i. SEBI does not give a guarantee for payment of money rather it helps you in recovering the amount back from the concerned entity broker. The investor has no role to play in the day-to-day management of the business or its control except as permitted by the law.

Investor carries on business when they buy and sell assets, arranges for other to buy and sell assets, manages assets belonging to others, or operates collective investment schemes. An investor engages these activities, but they are not having any control over the day-to-day activities of any corporate. Normally, an investor is a blind person; they do not know any activities made by the company.

Investor cannot guide the fate or destiny of the money invested. An investor to that extent is quite fragile and is exposed to certain risks because the utiliser of his money can commit mistakes. Normally they are contributing the funds for productive purpose of the company, and they are exposing him to the business decisions that the company has taken or will be taking. There are no doubt laws some of which are adequate but some are not.

An investor obviously needs some protection.

Investor protection is a very popular phrase which everyone concerned with regulation of the capital markets uses these days, be they the Securities and Exchange Board of India, Stock Exchanges, Investors associations or for that matter of fact the companies themselves.

The term Investor Protection is a wide term encompassing various measures designed to protect the investors from malpractices of companies, merchant bankers, depository participants and other intermediaries. Investor Beware should be the watchword of all programmes for mobilization of savings for investment. As all investment has some risk element, this risk factor should be borne in mind by the investors and they should take all precautions to protect their interest in the first place.

If caution is thrown to the winds and they invest in any venture without a prior assessment of the risk, they have only to blame themselves. Investors are a heterogeneous group, they are large or small, rich or poor, expert or lay and not all investors need equal degree of protection for their invested amount from the corporate securities. As an investor has three objectives while investing his surplus money, namely safety of invested money, liquidity position of invested money, and return on investment in selected securities.

Normally, an investor desires to have safety of his invested funds, liquidity of his investments and a good return with minimum risk. An investor can be classified as individual or professional who manages the funds on behalf of others. First there are inexperienced investor who needs to be properly advised about the intricacies of investment avenues and opportunities in corporate securities.

Role of SEBI in regulating/development of stock market | financetube

Thirdly, there are occasional investors who seek advice and assistance once in a while with no desire to create a long- term perspective. During s, there was a bearish trend in the Indian capital market.

During s, there is an unexpected bullish trend in the capital market. There is every uncertainty in terms of market price and rate of return. The uncertainty acts as barriers for many investors to enter into the stock market operations. The investors fear that there is no protection for their investments and immediate return as dividend.

The disclosure of information relating to the issue of securities, market operations, grievance redressal mechanism etc, is there but there is no regulator to give assurance relating to the return on investment and capital appreciation. In spite of these legislative measures, there are fraudulent companies, which are cheating the investors.

For example, in India around listed companies are available for trade in Bombay Stock Exchange and National Stock Exchange of India Ltd.

The remaining companies are enjoying benefit from the legal provisions of corporate veil from the Companies Act Recently the Central Government has identified nearly companies which were vanished. The Government also was unable to trace some companies managerial persons, proper communication addresses etc, and the Department of Company affairs filed a prosecution against 75 companies through the Registrar of Companies.

Some of the companies took advantage of the market conditions but later defaulted in their commitments made to the public while mobilizing funds. Some of these companies are not even traceable; the public has thus been cheated of their hard earned money. At present there is no ceiling on the quantum of issue of securities by the issuing companies and instead any number of securities can be issued for raising funds subject to the guidelines of SEBI for issue of securities.

Besides fresh issue of securities can be made either at free pricing or as a process of book building price. But dividend will be paid only on the par value, under this circumstance the investors will be benefited only when there is capital appreciation over and above free pricing or book building process pricing.

Whether the liberalized capital market followed by free pricing or book building process will protect the investors in terms of capital gain and return on investment or not? VIEWS For the Investor, Protection in the Indian Securities Market was the first empirical verification. They have found from their study, regulators through the legislative system took various protection measures.

The investors have lost their confidence, which is revealed in the increasing trend of grievances and complaints even after the establishment of the SEBI and administrative system of securities market.

WORRIES FOR THE INVESTORS In India, the worries for the investors in the securities market are shortage of application forms, preferential allotment to the financial institutions, miss-statements, concealment of facts and pushing the issue through advertisement, fraudulent company management, price volatility, price manipulation, insider-trading, unfair trade practices of brokers and sub-brokers, increasing the number of vanishing companies, lack of commitment for the corporate entities, stock market scams, price rigging, insider- trading, lack of professional expertise, defaults committed by brokers, multiplicity of number of investor complaints, absence of genuine investors, price rigging before issue, prevalence of insider-trading, lack of liquidity, scarcity of floating securities, lack of transparency, high volatility in the secondary market, dominance of public sector and financial institutions.

The Former Chairman of SEBI G. The same view was expressed in the report of the expert group headed by Justice Kania, for suggesting amendments to Securities and Exchange Board of India Act, deliberated that the investors in the equity market invest in risk capital and no assured return or compensation for non fulfillment of every expectation may be provided in the statute.

SEBI: The Purpose, Objective and Functions of SEBI

However, the compensation in respect of fraud or misrepresentations or miss-statements by companies or intermediaries may be considered. Further, the compensation to small investors in respect of fraud or misrepresentations or miss-statements by companies or intermediaries may be considered as a matter of investor protection.

Regulatory Framework At present, the five main Acts governing the securities markets are: Legislations The SEBI Act, The SEBI Act, was enacted to empower SEBI with statutory powers for: Its regulatory jurisdiction extends over corporate in the issuance of capital and transfer of securities, in addition to all intermediaries and persons associated with the securities market.

It can conduct enquiries, audits, and inspection of all concerned, and adjudicate offences under the Act. It has the powers to register and regulate all market intermediaries, as well as to penalize them in case of violations of the provisions of the Act, Rules, and Regulations made there under.

SEBI has full autonomy and the authority to regulate and develop an orderly securities market. Securities Contracts Regulation Act, This Act provides for the direct and indirect control of virtually all aspects of securities trading and the running of stock exchanges, and aims to prevent undesirable transactions in securities. It gives the Central Government regulatory jurisdiction over: As a condition of recognition, a stock exchange complies with the conditions prescribed by the Central Government.

Organized trading activity in securities takes place on a specified recognized stock exchange. The stock exchanges determine their own listing regulations, which have to conform to the minimum listing criteria set out in the Rules. The Depositories Act, provides for the establishment of depositories in securities with the objective of ensuring free transferability of securities with speed, accuracy, and security by: In order to streamline the settlement process, the Act envisages the transfer of ownership of securities electronically by book entry, without making the securities move from person to person.

It deals with the issue, allotment, and transfer of securities, as well as various aspects relating to company management. It also regulates underwriting, the use of premium and discounts on issues, rights, and bonus issues, the payment of interest and dividends, the supply of annual reports, and other information. Prevention of Money Laundering Act, The primary objective of this Act is to prevent money laundering, and to allow the confiscation of property derived from or involved in money laundering.

Besides prescribing the punishment for this offence, the Act provides other measures for the prevention of money laundering. The Act also casts an obligation on the intermediaries, the banking companies, etc.

Rules and Regulations The Government has framed rules under the SCRA, the SEBI Act, and the Depositories Act. SEBI has framed regulations under the SEBI Act and the Depositories Act for the registration and regulation of all market intermediaries, and for the prevention of unfair trade practices, insider trading, etc. Under these Acts, the Government and Forex copier service issue notifications, guidelines, and circulars that the market participants need to comply with.

The SROs, like the stock exchanges, have also laid down their own rules and regulations Investors Protection Fund IPF The Government has established an Investor Education and Protection Fund IEPF under Sec. The Government is required to utilize this amount through an Investor Education and Protection Fund. For this purpose, the proceeds from the companies are credited to the Consolidated Fund of India through this fund.

The Fund may then be entrusted with full fledged responsibility to carry out activities for education of investors and protection of their rights. BSE is the first Exchange to have set up the 'Stock Exchange Investors Protection Fund IPF in the interest of the customer's of the defaulter members of the Exchange.

This fund was set up secret money on the binary options trading 10th July, and has 60 seconds binary option demo account systems registered with the Charity Commissioner, Government of Maharashtra as a Charitable Fund.

The maximum amount of Rs. This has been progressively raised by BSE from Rs. BSE is the only Exchange in India, which offers the highest compensation of Rs.

The Trading members at present contribute 1 paisa per 1lakh of gross turnover. The Stock Exchange contributes 2.

Investor Awareness Program Launching the Securities Market Awareness Campaign organized by SEBI Januarythe Prime Minister said the prolonged quietness in the stock markets had tested the confidence of the small investor who was the backbone of the securities market. If investors are not etrade put options, then companies will not be able to raise money through the capital market.

The Indian household investor, off late, has been putting much of his savings in non-financial assets. Even with financial assets, most of the savings are going to the banking system. This is not the best or strength candles buy/sell forex indicator download most productive use of our savings, he said.

In recent years, there had been many instances of companies raising money from the market by creating hype and set selected option jquery by text defrauding the investor.

Many of them issued shares at hefty premiums; most of their scrip are now trading well below their face value. Stock market scams brought a bad name to the Indian business community.

This is how boom went bust and hopes turned stock market vs precious metals dust for many gullible investors. And that is how the investor community lost confidence in the market, leading to prolonged stagnation. The Prime Minister, therefore, called upon the market regulator and the intermediaries to learn the right lessons from our experience of the past few years.

He said we need markets that are known for their safety and integrity. Investor Awareness Program Investor Awareness programs are being regularly conducted by stock exchanges to educate the investors and to create awareness among the Investors regarding the working of the capital market and in particular the working of the Stock Exchanges. These programs have been conducted in almost all over the country.

Compensation to the Investors Capital market includes investment into risk bearing instruments. In such cases, the eforexindia flash 2 is required to make his own assessment of risk and reward. No compensation could be visualized for such investors whose investments were in risk bearing instruments. Similarly, investment in a fixed return instrument necessitated a careful review of the borrowing entity.

Such actions would also be subjected to known or declared risks. Besides, the capital market also provides an opportunity for an investor to exit. The need therefore, is to ensure proper and healthy market operation so that investors could exercise their exit options in a reasonable and equitable environment. However, there may be situations where such a frame work is distorted through frauds.

There may neopets get rich stock market provisions for compensation in the event of fraud by companies being established in securing funds from investors. For this purpose lifting of corporate veil may be enabled by the law. While entering into an Agreement: Share trading without demat account and every prospective client should read and understand the Risk Disclosure Document specified by the Exchange and before entering into trading in the Equities Cash or the Derivatives Segment.

The Client should obtain a signed copy of the same from the Trading Members. This agreement is mandatory for all Investors for registering as a client of a BSE Trading Member.

The Client should ensure the following how to earn money from yahoo answers entering into an agreement: Agreement has also to be signed by the witnesses by giving their name and address.

Obtain a valid Contract Note issued by Trading Member of the Exchange within 24 hours of the execution of the Trade. Contract note is a confirmation of trade s done on a particular day for and on behalf of a client in a format prescribed by the Exchange. It establishes a legally enforceable relationship between the Member and Client in respect of settlement of trades executed on the Exchange as stated in the Contract note.

Contract notes are charys market prices stock in duplicate, and the Member and Client both keep one copy each. Ensure that the Forex trading training in durban Note contains: Any additional charges that the Trading Member can charge are Securities Transaction TaxService Tax on brokerage, Stamp duty ,etc.

Arbitration clause stating that the Courts in Mumbai shall have exclusive jurisdiction in respect of all proceedings to which the Exchange is a party, and in respect of all other proceedings, the Courts having jurisdiction over the area in which the respective Regional Arbitration Centre is situated, shall have jurisdiction must be present on the face of the Contract note. Investor Grievance Redressal An effective investor grievance redressal mechanism at the corporate level could ensure protection of the interest of investors through timely interventions.

Disclosures and Investor Protection Proper and timely disclosures are central to safeguarding investor interests. The law should ensure a disclosure regime that compels companies to disclose material information on a continuous, timely and equitable basis.

Information should be disclosed when it is still relevant to the market. The companies should, therefore, be made to disclose routine information on a periodic basis and price sensitive information on a continuous basis. Capital market regulator and stock exchanges have a significant role to play in ensuring that such information is accessible by all market participants rather than a few select market players. Use of mcx gold commodity trading technology, internet, computers, should be enabled to enhance the efficiency of the disclosure process.

It should be possible to submit and disseminate financial and non-financial information by electronic means. Investor Rights and obligations Investor Rights: Investor Obligations The obligation to: No doubt, it is very difficult and herculean forexware review for the regulators to prevent the scams in the markets considering the great difficulty in regulating and monitoring each and every segment of the financial markets and the same is true for the Indian regulator also.

But what are the responsibilities of the regulators centrum forex bangalore cv raman nagar set the system right once the scam has taken place, especially the responsibility of redressing the grievances of the investors so that their confidence is restored?

One of the weapons in the hand of the regulators is the collection and distribution of disgorged money to the aggrieved investors. SEBI had issued guidelines for the protection of the investors through the Securities and Exchange Board of India Disclosure and Investor Protection Guidelines, The Securities and Exchange Board of India under Section 11 of the Securities and Exchange Board of India Act,have issued these Guidelines.

The national launch was closely followed by launches in 12 states. Educative Materials-SEBI has prepared a standardized reading material and presentation material for the workshops. All India Radio- With regard to educating investors through the usd myr exchange rate maybank of radio, SEBI Officials regularly participate in programmes aired by All India Radio.

Cautionary Message on television- With a view to use the electronic media to reach out to 30 000 rubles invested in the binary options larger number of investors, a short cautionary message, in the form of a 40 seconds film let, has been prepared and the same is being aired on television Internet based response system: A simple and effective internet based response to investor complaints has been set up.

On filing of your complaint electronically, an acknowledgement mail would be sent to your specified email address and you will be issued a complaint registration number instantaneously. Vice versa is also true. Besides the above rights, which you enjoy as an individual shareholder, you also enjoy the following rights as a group: Responsibilities of a security holder These are general and not statutory liabilities: Further, you also have certain protections brac epl stock brokerage limited defaults by your broker.

You also have the right to receive a contract note from the broker confirming the trade and indicating the time of apie forex prekyba of the order and other necessary details of the trade. If you have opted for transaction in physical mode, you also have the right to receive good delivery and the right to insist on rectification of bad delivery.

If you have a dispute with your broker, you can resolve it through arbitration under the aegis of the exchange, instead of filing a civil suit. However, you may not be satisfied with their response. Therefore, you should know whom you should turn to, to get your grievance redressed.

SEBI takes up grievances related to issue and transfer of securities and non-payment of dividend with listed companies. In addition, SEBI also takes up grievances against the various intermediaries registered with it and related issues. Always keep copies of all investment documentation e. Always keep copies of documents you are sending to companies etc. Ensure that you meaning of barter trade system money before you buy.

Always settle the dues through the normal banking channels with the market intermediaries. Ensure that you have are holding securities before you sell. Follow up diligently and promptly e. If you do not receive the required documentation within a reasonable time contact the role of sebi in regulating indian stock market person i. Mention clearly whether forex income engine rapidshare want to transact in physical mode or demat.

Investors should take informed investment decision without being influenced by misleading recommendations given in the public media such as newspapers, electronic forex brasilianska real, website etc. Before placing an order with the market intermediaries, please check about the credentials of the companies, its management, fundamentals and recent announcements made by them and various other disclosures forex sub niche under various regulations.

The sources of information are the websites of Exchanges and companies, databases of data vendor, business magazines etc.

Carry out due diligence before registering as client with any intermediary.

Carefully read and understand the contents stated in the Risk Disclosure Document, which forms part of the investor registration requirement for dealing through brokers. Be cautious about stocks which show a sudden spurt in price or trading activity, especially low price stocks. There are no guaranteed returns on investment in the stock market. Lodge your complaint or Arbitration Application against the Trading Member, at the concerned Regional Arbitration Centre, by confirming geographical jurisdiction.

Lodge your complaint against a company listed on BSE, at the concerned Regional Arbitration Centre, by confirming geographical jurisdiction. Please use your address for deciding the geographical jurisdiction. This will enable to process the complaint expeditiously.

Don't execute any documents with any intermediary without fully understanding its terms and conditions. Don't leave the custody of your Demat Transaction slip book in the hands of any intermediary.

Don't get carried away with advertisements about the financial performance of companies in print and electronic media. Don't blindly follow media reports on corporate developments, as some of these could be misleading. Don't blindly imitate investment decisions of others who may have profited from their investment decisions.

Investors are expected to submit their complaints in the prescribed Complaint format to the concerned Regional Arbitration Centre of BSE, by confirming geographical jurisdiction on the basis of an investor's address. Filing of complaint at the concerned Regional Arbitration Centre will enable to process the complaint expeditiously.

The services offered by the ISC are as under: Use of address for deciding the geographical jurisdiction.

Role of Securities & Exchange Board of India (SEBI) in Regulating Mutual Funds | Johnny Mera Naam - jyfyyuxy.web.fc2.com

DIS forwards the Complaints to the respective company and directs them to solve the matter within 15 days. Arbitration procedure against listed companies: It is proposed that the transferee investor may make any claim, difference or dispute against a company for delay in transfer of securities and delay in furnishing of the objection memo beyond the specified time of 1 month from the receipt of the securities by the company.

The company shall be liable to compensate the aggrieved party for the opportunity losses, if any, caused during the period of the delay. The Courts in Mumbai shall have exclusive jurisdiction in respect of all proceedings to which the Exchange is a party, and in respect of all other proceedings, the Courts having jurisdiction over the area in which the respective Regional Arbitration Centre is situated, shall have jurisdiction.

Grievance Redressal There will be occasions when you have a grievance against the company in which you are a stake-holder. You would like to know whom you should contact to get your grievance redressed. The following table would provide you the guidance in this regard. Investor Information Centres have been set up in every recognized Stock Exchange Which in addition to the complaints regarding the trades effected in the Exchange and the relevant trading Member of the Exchange.

Investors Grievances —Rights and Remedies Misleading Advertisements In certain cases publicity material, circulars, the companies, Trading Member or Intermediaries inviting applications from the public for subscription to shares debentures, publish brochures. However, these publicity materials may not form part of the prospectus or letter of offer. Investors have complaints against the advertisement, brochures, circulars which have exaggerated claim of the performance of the company.

This practice could be misleading to the investing public because it may contain the information not included in the prospectus. In case of misleading advertisements, the investor may refer to Section 68 of the Companies Act and write to Ministry of Corporate Affairs MCA.

The investor can file complaints before the District Forum, state Commission or National commission. The Investor can write to SEBI in case of misleading, advertisements, circulars or brochures.

The investor has to make investment decisions on incomplete facts and information. Investors can claim compensation for loss suffered by them on account of misstatements made in Prospectus. Investors can write to SEBI and obtain redressal with regard to misstatements in the prospectus, etc.

Delay in listing of Securities Some of the companies state in the prospectus that an application has been made to one or more. However, there is no guarantee that permission will be granted by the Stock Exchange authorities. In certain cases, companies are unable to complete the said formalities within the prescribed time.

Delay in Dispatch of securities A share certificate under the seal of the company is prima-facie documentary evidence to title of the shareholder to the shares specified therein.

In case of delay in dispatch of securities, the investor may refer to Section of the Companies Act and write to the MCA. Investors can write to SEBI and obtain redressal with regard to delay in dispatch of securities. Thus, the transferee may in the intervening period lose certain benefits due to him i. In case of delay in transfer of securities, the investor may refer to Sectionof the Companies Act and write to the Company Law Board CLB and the MCA respectively.

Role of SEBI in the Indian Stock Market (Hindi)Investors can write to SEBI and obtain redressal with regard to delay in transfer of securities. Delay in Payment of Interest on Debentures Investors who would like to have fixed return by way of interest, normally invest in debentures on the assumption that the debentures are secured and risk free investments.

Investors are advised to verify whether the company is healthy or sick and check the credit rating of the company before making such investments. There have been instances where investors have complained of non-receipt or delay in the receipt of debentures certificates or interest thereon, non-appointment of Debenture Trustee or non-creation of the stipulated security. Investors can write to SEBI and obtain redressal with regard to delay in payment of interest on debentures.

Non—Payment of Dividends The company with the approval of the shareholders declares dividends in its general meeting. Accordingly, a resolution-declaring dividend payable by the company is passed.

This becomes a debt due by the company to the shareholders. In certain cases the shareholders complain on non-receipt of the dividend declared by the company. Investors can write to SEBI and obtain redressal with regard to non-payment of Dividends. More efficient is the securities market; the greater is the promotion effect on economic growth. It is, therefore, necessary to ensure that securities market operations are more efficient, transparent and safe.

The investors need protection from the various malpractices and unfair practices made by the corporate and intermediaries. As the individual investors community and the investment avenues are on the rise, it is interesting to know how the investors shall be protected through various legislations.

Securities market in general are to be regulated to improve the market operations in fair dealings and easy to access the market by corporate and investors. The present positive attitude of investors is heartening though investor sentiments have been shaken by the various scandals. Even though, there are various opportunities available for investment, investors are scared of investing in corporate.

In this situation, the individual investors protection becomes necessary to sustain the economic development of all countries. Globally, there is increased evidence to suggest that investor protection has assumed an important role in the economic development of a country.

Integrity of the financial markets and economic well being of the country depend on corporate accountability and investor confidence. The global concern to make capital markets safer, transparent, strengthening financial system and managing the crisis cannot be quickly fixed. But they add up to a stronger system.

The global evidence suggests that every time there is stock market crisis, money pours into bank deposits. As we have seen that via different guidelines it had made it sure that no stone remains unturned in the path of the mission of protecting the investors.

Again with economic recovery in the country, the funds are diverted to the markets. Investors panic when markets slide.

It is important for investors to realize that returns on equities are cyclical in nature and also, market moves up and down with time. Understanding market and being patient while market is going down is important while investing in equities.

If the investors have not been protected properly by means of rate of return and capital, the corporate will not be able to collect the funds from the market with cheap rate and effectively in future days. For gaining the confidence of investors in the securities market there is a need to provide an adequate rate of return and fair operating efficiency of corporate in the securities market, then the investors lure back to market. This can be done by a series of systematic measures, which would build their confidence in the systems and processes and protect the interest of investors.

Lawyers in India - Click on a link below for legal Services lawyers in Chennai lawyers in Bangalore lawyers in Hyderabad lawyers in Cochin lawyers in Pondicherry lawyers in Guwahati lawyers in Nashik lawyers in Jaipur lawyers in New Delhi lawyers in Dimapur lawyers in Agra Noida lawyers lawyers in Siliguri For Mutual consent Divorce in Delhi Ph no: Law Articles - India's Most Authentice Free legal Source Online.

Register your Copyright Online We offer copyright registration right from your desktop click here for details. Contact us at Ph no: Name Email Copyright Registration To Copyright Your Books, Videos, Songs, Scripts etc Call us at: Protection of the interest of the investor Save as.

Print Email to friend. View articles Contact author. Types of Complaints Can be taken up with a. Re-validation of transfer deeds Registrar of Companies RoC b. Regarding bad delivery of shares Bad Delivery Cell of the Stock Exchange c. Regarding shares or debentures in unlisted companies Ministry of Corporate Affairs d. Deposits in collective investment schemes like plantations etc. Units of Mutual Funds SEBI f. Fixed Deposits in Bank and Finance Companies Reserve Bank of India g.

Fixed Deposits in manufacturing companies Dept. Non-receipt of interest for delay in: Home About Us Privacy Terms of use Divorce by mutual consent Lawyers Submit article S C Judgments Contact Us. Mutual Consent Divorce in Delhi We provide fast, cost effective and Hassle free solution. Banking and Finance laws. Gay laws and Third Gender. Legal Aid and Lok Adalat. Subscribe now and receive free articles and updates instantly. To Copyright Your Books, Videos, Songs, Scripts etc Call us at: Dividend Bonus Rights form Buyback letter of offer Delisting letter of offer Annual Report.

Refunds Dividend Interest on debt security Redemption of debt security Securities. Most viewed articles in Banking and Finance laws category. Most recent articles in Banking and Finance laws category. COMPANY FIRST SEND DIVIDEND BY NEFT. GET REJECTED FOR VARIOUS REASONS.

COMPANIES THEN GET DD AND SEND BY POST EVEN FOR A VERY SMALL AMOUNT. Posted by PUTHU RAJA P. Posted by ganesh tak on February 03, Posted by Nagesh Bharat on March 24, Your site is an extreamly good one. God bless you to continue this. Please login or register a new free account. Technology backed enterprises are based on information and knowledge. Starting from Ford Cars to Microsoft Software are the product of knowledge and its organized application Lawyers in India - Click on a link below for legal Services.

For Mutual consent Divorce in Delhi Ph no: For online Copyright Registration Ph no: