Stock picking vs index funds

Index Funds vs. Mutual Funds -- The Motley Fool

The largest stock fund and biggest bond fund today are both index-tracking or passive funds, rather than actively managed funds. Analysts even say index investing has become the mainstream approach , citing the latest data on where investor money is flowing. Stock pickers are fighting back, saying the enthusiasm over index funds and ETFs has gone too far.

Other analysts stress that the active versus passive debate often becomes too simplistic, as they argue no one is a purely passive investor. Read on for five charts that detail the big shifts, some counterarguments and what may lie ahead. But for many companies that run actively managed mutual funds, each scorecard might bring back memories of those report cards that you tried to hide from your parents.

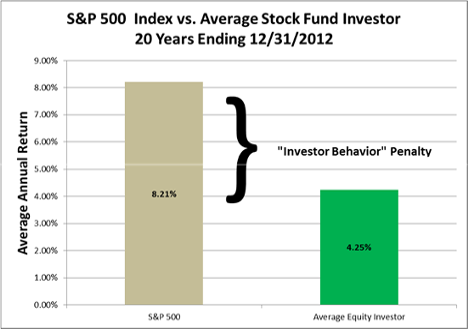

And this continual underperformance is a huge driver in the shift toward index funds. Stock pickers have performed better so far this year, as stories here and there have noted.

Prominent financial adviser Josh Brown, known as the Reformed Broker, also has pointed out recently that active managers may be enjoying a renaissance by taking greater risks. Active-fund giants offer a different take on such data. More on that ahead. That is according to a report this month from Sebastian Mercado, a Deutsche Bank strategist.

The growth in indexing has been big enough to spark worries about rising correlations, greater volatility and higher market-wide risks, though analysts have responses to these common fears. Indexing pioneer Vanguard has emphasized here and there that passive products are still in the minority overall. One way that stock pickers are fighting back is by creating an entirely new type of fund—an exchange-traded managed fund or ETMF —that is meant to provide a more level playing field.

An index fund can provide a better return than the typical active fund in large part because the passive product has lower costs. Eaton Vance, which secured regulatory approval for the ETMF in November, has said fund managers who switch to the ETMF structure will fare better because the new format will cut out transfer agency fees and other pricey aspects of mutual funds, while still only disclosing holdings quarterly.

Another challenge is the market has become more dominated by big institutions, according to Lazzara. You could envision a situation where the vast majority of institutions outperformed because the person on the other side of the trade is less sophisticated than they are. It is much harder to envision that now.

He said nobody actually invests in the average active fund, or all active funds in aggregate, and instead investors can screen for certain qualities to boost their chances of success. Stock pickers also are fighting back through ads that tout outperforming active funds like the Fidelity Low-Priced Stock Fund FLPSX, What about when the current bull market ends? A smart-beta ETF might give all components the same weight, or tilt toward the stocks with the lowest valuations, the biggest dividends or the least volatility.

Well, smart-beta ETFs can outperform. But they also draw plenty of flak. And speaking of the space between active and passive, that is where all investors operate because active versus passive is a myth , argues Cullen Roche over at the financial blog Pragmatic Capitalism. Roche, an occasional MarketWatch contributor, writes that all investors deviate from exactly tracking the global portfolio of all financial assets. By using this site you agree to the Terms of Service , Privacy Policy , and Cookie Policy.

Intraday Data provided by SIX Financial Information and subject to terms of use. Historical and current end-of-day data provided by SIX Financial Information.

All quotes are in local exchange time. Real-time last sale data for U. Intraday data delayed at least 15 minutes or per exchange requirements. Updated Financial advice from the man drafted one spot after Peyton Manning. What's Next for Uber After its Founder Quits? Oil falls to lowest settlement in more than 10 months. WTI oil futures log lowest finish since August. August WTI oil falls 98 cents, or 2. Opinion Georgia vote shows again that Democrats are a party of condescension, not hope.

This news anchor who filled four minutes of dead air doing nothing just won the internet. Libeskind Looks Back on Ground Zero. Updated Oil spirals to month low as U. Updated Gold rebounds after 2-session drop to lowest since mid May.

Altice USA ups IPO offering to Home News Viewer Video SectorWatch Podcasts First Take Games Portfolio My MarketWatch.

Index Funds vs. Mutual Funds -- The Motley Fool

Retirement Retire Here, Not There Encore Taxes How-to Guides Social Security Estate Planning Events Columns Robert Powell's Retirement Portfolio Andrea Coombes's Working Retirement Tools Retirement Planner How long will my money last?

Economy Federal Reserve Capitol Report Economic Report Columns Darrell Delamaide Rex Nutting Tools Economic Calendar. My MarketWatch Watchlist Alerts Games Log In.

Until New York Markets Close Market Snapshot Winners and Losers. Home Investing Slide Show Get email alerts. A tougher environment for stock pickers? They have a tougher task than in the past, according to some analysts. Morningstar Fans of stock-picking tout outperforming active funds like the Fidelity Low-Priced Stock Fund in blue. APR Last Week 6 Months Low Interest MarketWatch Site Index Topics Help Feedback Newsroom Roster Media Archive Premium Products Mobile.

Dow Jones Network WSJ. Fidelity Low-Priced Stock Fund U.