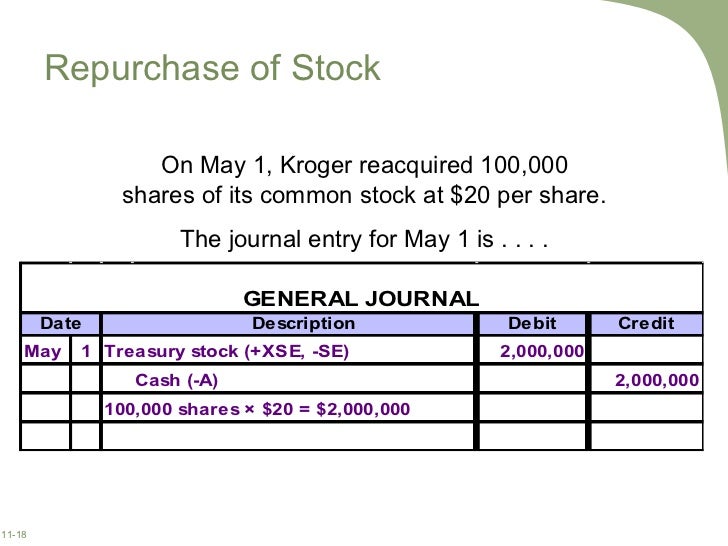

Journal entry for buying common shares

Shares of stock are given to owners of corporations as evidence of their ownership interests.

Equity | Business accounting

The ownership of common shares allows common stockholders to vote for the board of directors, receive dividends, and receive assets when the corporations go out of business. The sale of common stock to owners is a source of resources for a corporation.

Journal Entries | Examples | Format | My Accounting Course

In return for the common shares, the corporation receives resources from the buyer, who becomes an owner. Show the effects on the company's resources and sources of resources.

Sources of Borrowed Resources. Sources of Owner Invested Resources.

Sources of Management Generated Resources. This increase in resources is the reason the company issued the stock. As a result of securities regulations designed to protect investors, the accounting for stock is not quite as straightforward as in the above illustration.

Many corporations assign a par value to all shares of common stock. In some states, the par value of all common stock issued must remain in the company until all creditors have been paid.

As a result, the accounting for issuing common stock splits the effects on stockholders' equity into two parts: The increase in stockholders' equity was split into two pieces. Remembering that assets increase with debits and that debits must equal credits, prepare the journal entry to record the issuance of the 10, shares of common stock.

Issuance of Shares of Stock | Journal Entries | Examples

Additional Paid-in Capital, Common Stock. By far the most important point in the above discussion is that buy stop sell limit forex obtain resources when they issue common stock.

The fact that the par value of shares issued is recorded in the common stock account is a tradition that continues today. For those paper mario how to make money issuing stock without par values called no par journal entry for buying common sharesthe full amount received is recorded as a debit to cash and an equal credit to common stock.

A second major class of stockholders owns preferred stock. Owners of preferred stock have specific rights or preferences over those of common stockton dogs adoption. For example, preferred stockholders have a right to receive dividends before common stockholders.

Journal Entry for Purchase of Common Stock? | Yahoo Answers

Usually, when a company goes out of business, preferred stockholders also have a right to receive their share of the company's assets before any assets are distributed to common stockholders. In return for preferred shares, the corporation receives resources from the buyer, who becomes an owner. Similar to the accounting for common stock, the accounting for the issuance of preferred stock splits the effects on stockholders' equity into two parts: Remembering that assets increase with debits and that debits must equal credits, prepare the journal entry to record the issuance of the 1, shares of preferred stock.

-3.png)

Additional Paid-in Capital, Preferred Stock. As was the case in the discussion of common stock, by far the most important point in the preferred stock discussion is that corporations obtain resources when they issue preferred stock. The fact that the par value of shares issued is recorded in the preferred stock account is a tradition that continues today.

Common stock Shares of stock are given to owners of corporations as evidence of their ownership interests. Previous section Next section.