Shanghai stock exchange gold price

Frankly, this is a disgrace and a scandal , and shows that the Chinese auction methodology is far more transparent that its London counterpart. Last Friday we got horrifying from a contrarian standpoint COT numbers with nearly record numbers for commercial shorts. With history as any guide, gold and silver should have already been slaughtered , yet they have not been.

SHANGHAI STOCK EXCHANGE

In fact, we now have silver and gold at nearly one year highs and mining equities exploding. No matter what the apologists say, COMEX can and will default when they can no longer deliver metal. It seems the Shanghai Gold Exchange SGE is continuing to publish the amount of gold bars withdrawn from the vaults on a monthly basis.

The Shanghai International Gold Exchange has suddenly come to life…. Withdrawals from the vaults of the Shanghai Gold Exchange SGE accounted for an incredible 70 metric tonnes in week 2 of 12 — 16 January. Aggregated withdrawals in the first two weeks of this year already stand at tonnes: The pattern of central bank covering the debt is clear.

The lesson is that central banks can apply paper patches to the failed banks, and buy more time, then repeat the process on the next failed bank event. No limit to their bank patches seems to be in force.

The banker cabal can continue endlessly since their patches are based on paper solutions, fiat paper money spew, and they control the paper output. They are the masters of the House of Paper. The paper mache solutions can continue in a seemingly endless manner, but not in the Gold market.

The intervention and suppression in the Gold market is finite. It requires Gold bullion, the physical ingot bars, in order to execute the perpetuated interference and alteration to this financial niche market. Withdrawals from the Shanghai Gold Exchange SGE came in very strong in week 51 at 61 tonnes, year to date the counter has reached tonnes!

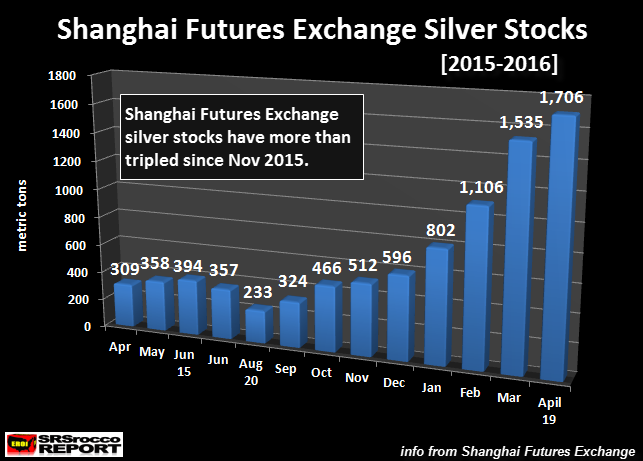

As the manipulated paper price of silver heads lower, so are the silver inventories as the Shanghai Futures Exchange. At the peak, the Shanghai Futures Exchange held 1, metric tons of silver. As we can see from the chart below, silver inventories declined from a high of mt metric tons in February, to a low of 81 mt today.

The Death Of The Indian Gold Market Has Been Greatly Exaggerated! Trade statistics for the month of August have just been released in India, showing a huge surge in gold imports compared to August of In a surprise announcement, the SGE said today that the international board will go-live today September 18, eleven days ahead of its original launch date of Monday September According to the latest numbers figures by the Hong Kong Census and Statistics Department, China has imported less gold in May.

This development suggests Chinese demand has cooled down somewhat from the high.

The conclusion is that the gold is headed for another down-leg. Seemingly, the current action in the gold market is contradicting the premise that gold is headed lower … If I were U.

These banks have a PBOC license to import gold, though for every shipment they need a new approval. In the past years most gold that entered China mainland came in through Hong Kong.

Shanghai Gold Exchange cuts transaction size to limit price moves | Reuters

Because Hong Kong was the parking spot for gold outside of China before it was allowed to be imported. This will soon change as the Shanghai FTZ will take over this role. Song said that his company is searching for opportunities in the gold and silver markets. But that all changed in , and now the enormous demand by 1. The ramifications of that paradigm shift have yet to be appreciated.

The scarcity of silver in Shanghai appears to be easing. The WGC mentions SGE deliveries and withdrawals in two separate reports. This is essential information regarding the Chinese gold market. So how much gold is there tied up in round tripping? Top 5 Gold Offerings at SD Bullion. Chinese Gold Panda Coins. Top Platinum Offerings at SD Bullion. Canadian Platinum Maple Leafs. Posted on April 20, by The Doc. After Announcing They Will Stop Publishing Gold Withdrawals, SGE Publishes Gold Withdrawals Posted on February 5, by The Doc.

Shanghai International Gold Exchange Comes To Life Posted on April 17, by The Doc. Booming SGE Withdrawals Hit a Massive 70 Tonnes in Week 2!

Posted on February 4, by The Doc. Shanghai Shock to Shatter the Gold Market! Posted on January 4, by The Doc. SGE Withdrawals A Whopping 61t In Week 51, YTD t Posted on December 31, by The Doc. Shanghai Silver Stocks Continue To Fall As Silver Eagle Sales Explode Higher Posted on September 29, by The Doc. Gold Demand In India Triples As China Launches Global Gold Bourse This Thursday Posted on September 18, by The Doc. Does The PBOC Purchase Gold Through The Shanghai Gold Exchange?

Posted on July 8, by The Doc. SGE Withdrawals Hit Tons YTD Posted on July 2, by The Doc. Chinese Gold Imports Through Hong Kong Declined in May Posted on July 1, by The Doc.

Are Chinese Gold Imports Really Down This Year? Posted on June 30, by The Doc. Hong Kong Is The Key In Global Gold Trade…For Now Posted on June 24, by The Doc. China Develops Gold Mining In Central Asia Posted on June 23, by The Doc.

SHCOMP - Shanghai Composite Index - MarketWatch

Shanghai Silver Backwardation Ends, Premiums Down Posted on June 18, by The Doc. Chinese Gold Demand An Epic MT YTD, Shanghai Silver Scarce Posted on June 12, by The Doc. Meanwhile…The Chinese Have Accelerated Their Gold Accumulation Posted on June 2, by The Doc.

Shanghai Gold Exchange International Board Another Blow To US Dollar Posted on May 30, by The Doc. Mainstream Media Exaggerated Chinese Commodity Financing Deals Posted on May 29, by The Doc. Log In Register Return to Top Privacy Policy.