How to redeem preference shares in singapore

Please enter a maximum of 5 recipients. Use ; to separate more than one email address. A proliferation of start-ups in Asia in the high-tech and internet-related industries have embarked on a search for capital to fund their expansion. This search, for the most part, is moving towards venture capital migrating into Asia from Silicon Valley, and other financial centres in the US and Europe.

Investment terms in typical venture fundings of Singapore start-ups in the high-tech and internet-related industry have been patterned after many aspects of the Silicon Valley investment model.

S | Hargreaves Lansdown

This article provides an introduction to the key aspects of this investment model, and some issues that often arise in applying this model in Singapore. The venture capitalist VC in the US which in this article refers primarily to California typically seeks to protect its equity investment and to obtain tax advantages by investing through preference shares.

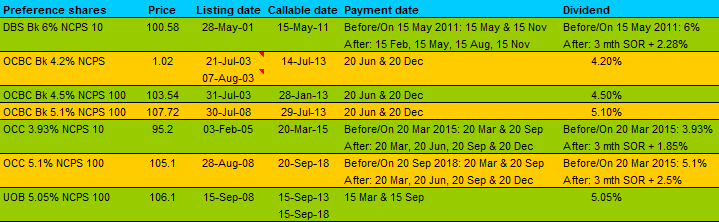

For the same reasons, preference shares are typically used in investments in Singapore start-ups. Under Singapore law, preference shares generally mean shares carrying preferred rights to dividends and return of capital on liquidation and therefore rank before ordinary shares.

They can also confer preferential rights. These rights would typically include redemption, directorship, conversion, anti-dilution and other rights. Much of the following discussion relates to structuring these preferences. Capital gains are generally not taxed in Singapore.

On this basis, the use of preferred or ordinary shares, as opposed to debt instruments, in an investment into a Singapore start-up also provides tax advantages.

The appreciation in share price is generally regarded as capital gain, and is not subject to tax. There are, however, exceptions. For example, the VC's holding of preferred shares in different start-ups may be regarded as its stock-in-trade.

Profits from the sale of such preferred shares although capital in nature may accordingly be charaterized as income from the sale of stock-in-trade the preferred shares for tax purposes, which is subject to income tax. Valuation directly affects the pricing and amount of shares to be issued in the venture financing. Both are important issues to the start-up as they determine the portion of and the price at which the start-up is given up to the VC.

As in the US, Singapore start-ups are valued on the basis of financial as well as legal factors. These legal factors include:. Investments into early-stage start-ups in the US are likely to be staged, such that the VC makes an initial investment, upon terms that require the VC to make a subsequent additional investment if certain milestones are met.

This limits the VC's losses if the start-up fails. Staged financings are also used in Singapore for the same reason.

They may be structured in different ways, including the following:. In this structure, the start-up issues preference shares that are not be fully paid up. The articles of association of a Singapore private limited company usually disallow a shareholder from exercising his voting rights at shareholders' meetings unless he has fully paid up all shares. The VC should therefore ask to amend the articles of association in this regard, or negotiate special golden share rights in the articles of association to exercise control on fundamental matters pending full payment on the preference shares.

In practice, the lack of voting power after the first closing would not cause too much concern. The VC would generally have veto voting rights independent of the number of shares the VC holds on fundamental matters in the investment agreements and the articles of association of the company. A VC investing in the US may require the start-up to redeem the preference shares after a certain period of time.

This allows the VC to recover his initial investment, often with a slight premium on account of cumulated but unpaid dividends. For the same reasons, redeemable preference shares are used in some venture financings in Singapore. The use of redeemable preference shares in Singapore may not, however, give the VC the assurance of recovering its investment.

This is because Singapore company law only allows preference shares to be redeemed out of profits or a fresh issue of shares. Redemption by way of a fresh issue of shares requires new capital from a third party.

The Share Capital in Singapore

As start-ups seldom turn profitable before an IPO or a trade sale, redemption out of profits appears unlikely.

Redemption is, in any event, not the preferred exit for the VC as the VC typically obtains a low return on its invested funds. Typically, exit via an IPO or a trade sale of the start-up yields much higher returns. In contrast to preference shares or equity securities, a VC in the US and in Singapore may also invest in the start-up using debt instruments such as convertible loan stock.

In both the US and in Singapore, convertible loan stock is regarded to combine the security commonly associated with debt instruments loans generally have priority over equities in a distribution of the start-up's assets upon a liquidation , with the upside potential commonly associated with equity. The use of convertible loan stock in a Singapore start-up may however drive up its gearing and other debt-related ratios.

The use of convertible loan stock may also result in a less favourable tax position, as interests on loans are generally chargeable to Singapore income tax. In both the US and in Singapore, the VC often requires the right to appoint at least one director to the start-up's board.

This is important primarily for the VC to monitor its investments and to exercise its veto rights on fundamental matters. A few issues arise with respect to VC-appointed directors of a Singapore start-up.

Under Singapore law, VC nominee directors are under a statutory duty, among others, to act in the best interest of the company. This may conflict with the nominee's ability to act in the interest of the VC. Imposing directors' duties on VC nominee directors may present other special problems because of the penalties on a breach of such duties.

The start-up may resist VC nominee directors for fear of the nominee's disagreement with board decisions and the consequential exercise of veto rights, and for other reasons. The start-up's resistance and a desire to avoid director's duties may cause the VC to ask for board observance rights instead.

The use of board observers may however not sufficiently address director's duties concerns. This is because under Singapore company law, VC board observers may be shadow directors if they are able to control or direct the decisions of the board; shadow directors are similarly subjected to directors' duties.

In the alternative, the VC and the start-up may agree to independent non-executive directors acceptable to both parties to hold the balance of voting power at the board level. Corporate entities acting as nominee directors is an often used mechanism to limit liabilities arising from director's duties in jurisdictions outside Singapore. This mechanism is unavailable in Singapore as Singapore company law requires directors to be natural persons as opposed to corporations.

VC-nominated directors cannot limit their liability with the use of corporate entities — the incorporated VC itself or a special purpose corporate vehicle. As an alternative, the VC should obtain appropriate director's insurance for its nominees. In both the US and in Singapore, preferred shares are generally structured such that they may be converted into ordinary shares at an agreed conversion ratio.

Conversion rights are often exercised before an IPO, trade sale or other exit event which relates to ordinary shares. The initial conversion ratio is usually 1: To enable conversion, a US corporation would authorize and reserve the number of ordinary shares for issuance upon the VC's conversion of its preferred shares in its certificate of incorporation.

This practice is not followed in Singapore as the memoranda of association of a Singapore start-up which, broadly speaking, corresponds to the certification of incorporation contains primarily the object clauses of the start-up.

Clauses relating to preferred share rights and the reservation of ordinary shares for conversion are not usually incorporated in the memoranda as a practice. A further reason may be that such incorporation possibly entrenches the clauses incorporated; once incorporated, the effect of Singapore company law is that such clauses cannot be amended. Instead, the Singapore start-up would covenant in the investment documents, and its articles of association, to take all corporate and other action required for the reservation of ordinary shares necessary for issuance upon conversion.

Such reservation is usually carried out by way of a shareholders' resolution. The articles of association of a Singapore company correspond, broadly speaking, to the bye-laws of a US corporation.

Preference Shares for Singapore companies | jyfyyuxy.web.fc2.com

Together with conversion rights, the VC investing in US and Singapore start-ups typically negotiates for and obtains anti-dilution protection. This ensures that subsequent issuance of shares or other equity securities are not made below the issue price of its preferred shares, without an appropriate increase to the conversion ratio. Like a VC investing in the US, the VC investing in a Singapore start-up may exit either via an IPO or a trade sale of all of the start-up's shares or assets.

In Singapore, an IPO comprises a public offering of shares of the start-up contemporaneously with a listing on the Singapore Securities Exchange Trading Limited SGX. IPOs are desired, apart from achieving exit for the VC, for the profile advantage to the company. By no means less desirable in a market where the appetite for internet stocks has waned, is the complete sale by all shareholders of the company to a large corporation, usually a multinational corporation.

In this regard, there appears an increasing trend in Singapore for trade sales of start-ups to strategic corporate purchasers, whose businesses may be complemented by that of the start-ups'. The key terms and issues for venture financing of Singapore start-ups, as with the internet phenomenon in Asia, is still in the process of evolving.

With many managers of venture capital and other funds in Asia schooled in the Silicon Valley VC investment model, it is not surprising that many of the concepts and practices of the Silicon Valley model are being imported into the investment terms for Singapore start-ups.

We believe that most of these concepts and practices, which have been developed over and with the benefit of the experience of many years of venture financing in the Silicon Valley, can be imported into Singapore without excessive difficulty.

Where required, modification on account of Singapore law can be made. The material on this site is for financial institutions, professional investors and their professional advisers. It is for information only. Please read our terms and conditions and privacy policy before using the site. All material subject to strictly enforced copyright laws. For help please see our FAQ. Planning for financings in volatile markets. Get unlimited access to IFLR. Read IFLR's global coverage whenever and wherever you want for 7 days with IFLR mobile app for iPad and iPhone "The format of the Review has changed over the years; the high quality of its substantive content has not.

In common with most websites, this site uses cookies to carry out various tasks including improving our users' experience. Cookies are pieces of information which include a unique reference code that a website transfers to your device.

To carry on with cookies running, click proceed or click the X to close this window and continue browsing. You can review your cookie options at any time by clicking on the Cookies link at the foot of each page. Email a friend Your name: Please enter your name Your email: Please enter your email address Please enter a valid email Please enter a maximum of 5 recipients. Please enter an email address Please enter valid email addresses Recipient name s: Please enter a recipient name Email yourself a copy?

Key issues The venture capitalist VC in the US which in this article refers primarily to California typically seeks to protect its equity investment and to obtain tax advantages by investing through preference shares. Valuation Valuation directly affects the pricing and amount of shares to be issued in the venture financing.

These legal factors include: Amount and timing Investments into early-stage start-ups in the US are likely to be staged, such that the VC makes an initial investment, upon terms that require the VC to make a subsequent additional investment if certain milestones are met. They may be structured in different ways, including the following: Redemption A VC investing in the US may require the start-up to redeem the preference shares after a certain period of time.

Form of investment In contrast to preference shares or equity securities, a VC in the US and in Singapore may also invest in the start-up using debt instruments such as convertible loan stock. Directors In both the US and in Singapore, the VC often requires the right to appoint at least one director to the start-up's board. Conversion and anti-dilution In both the US and in Singapore, preferred shares are generally structured such that they may be converted into ordinary shares at an agreed conversion ratio.

Exit strategy Like a VC investing in the US, the VC investing in a Singapore start-up may exit either via an IPO or a trade sale of all of the start-up's shares or assets. Concluding remarks The key terms and issues for venture financing of Singapore start-ups, as with the internet phenomenon in Asia, is still in the process of evolving. Where required, modification on account of Singapore law can be made Orrick HelenYeo 10 Collyer Quay Ocean Building Singapore Tel: Upcoming events 8 Oct.

Most read articles Slovak Republic: Public Partners Register Japan: Virtual currency exchange Guatemala: Financial transaction confidentiality Brazil: PPI second phase Philippines: Web seminars Planning for financings in volatile markets Jul 12, 4: Supplements Dispute resolution Special Focus Turkey Special Focus Insolvency and Corporate Reorganisation Report Asia Fintech Special Focus Philippines Special Focus.

Register today to read IFLR's global coverage.