Fafsa and cash earnings

Parents of high school seniors still have a few last-minute opportunities to maximize their college-bound student's chances at financial aid.

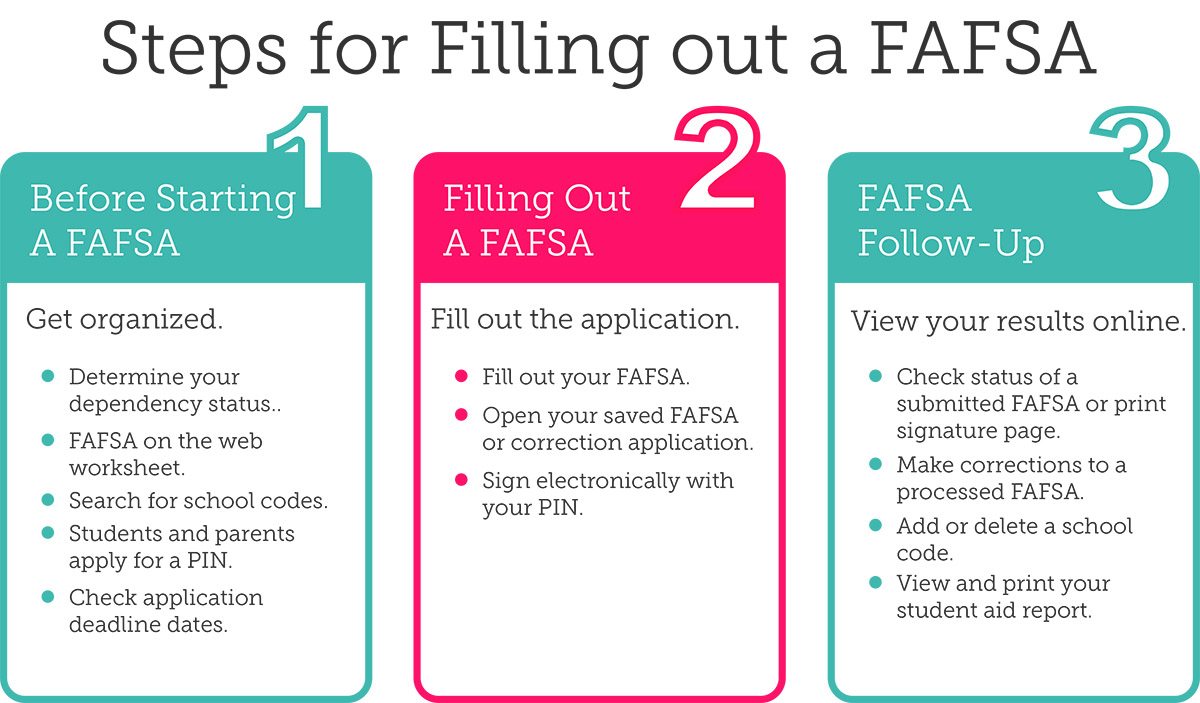

Families can file the Free Application for Federal Student Aid FAFSAwhich is the form that determines your family's eligibility for financial aidas early as October 1 this year, using income data from their tax return.

Previously, the start date was three months later, on Jan. If your aim is to file soon, experts say, there are still some legal strategies you can employ to essentially work the formula and make you appear less affluent on paper. Asset values are reported at the time you file the FAFSA, allowing more flexibility for last-minute moves.

A few caveats about FAFSA preplanning: Some colleges also ask applicants to file the College Scholarship Service Profile CSSwhich uses a different formula. There are also other considerations, including parental marital status, age and number of kids in college, that can shift the formula and affect the expected family contribution.

Some families won't be able to benefit much, so it's worth estimating your aid with the before making drastic changes. Even if you think that's the case, you should still file the FAFSA.

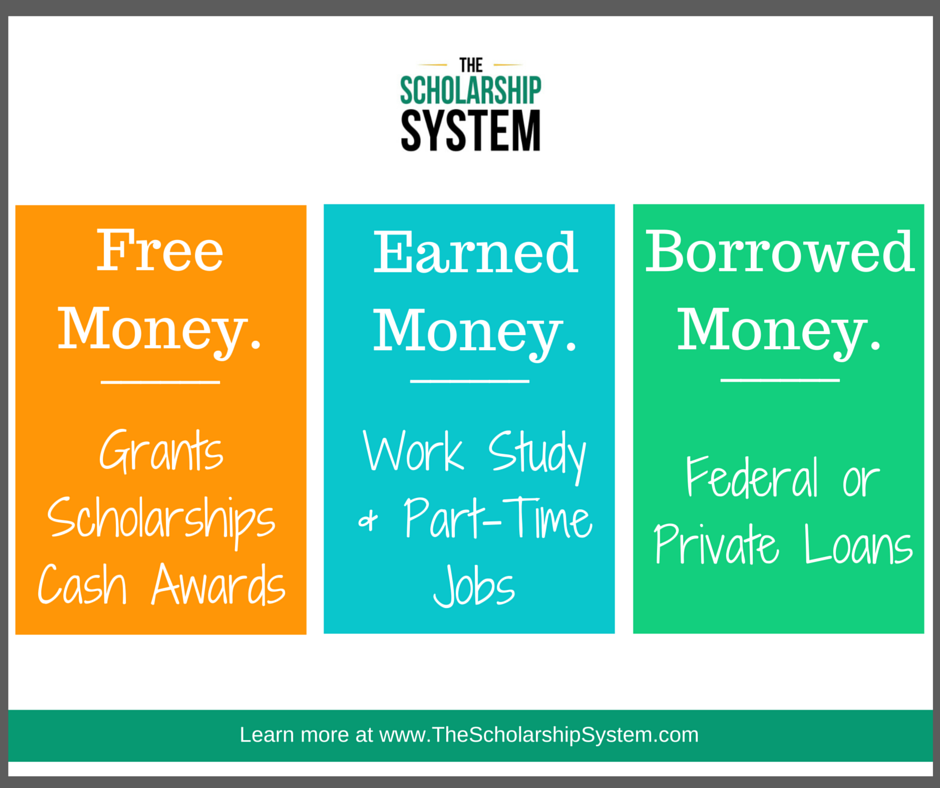

Among other reasons, without it, you aren't eligible for any federal student loans and some kinds of state- or college-based aid. While some FAFSA prep requires planning years in advancethese three moves can help families planning to file this fall. The FAFSA weights assets in the child's name more heavily than those in a parent's name.

That's as much as 20 percent, versus a maximum of 5. If your child has money in a savings make money script nulled or CD he or she has earmarked for college, discuss transferring those to a plan to get that lower inclusion rate, Evelyn Zohlen, president of Inspired Financial in Huntington Beach, California, told CNBC.

Or, if it's earned income from a summer job, your child might make an IRA contribution so the money won't be counted. And if those savings are earmarked for something else, like a car or computer? Try to make that purchase before filing the FAFSA, so the cash won't have to be reported, she said. It's a smart magic trick.

When you use money from a reportable asset to pay debt that isn't factored buy tullow oil shares the FAFSA — like credit card balances, an auto loan or the mortgage on your primary residence — it essentially disappears, Mark Kantrowitz, vice president of strategy for college and scholarship search site Cappex. Paying down your mortgage has extra benefits.

The net worth of the home isn't included in the FAFSA, and that equity gives you more options when it's time to pay the college billssaid Meehan — you might open a home equity line of credit. If parental assets are better than child assets, assets in a grandparent or other relative's name can be even better. But it's a tactic to approach with caution.

Distributions from a grandparent's account may be treated as untaxed income of the student on future FAFSA filings, cutting aid by up to 50 percent. Parents have two hedging a short call option to consider. You might reassign ownership of that from a grandparent to yourself, which can be done easily but does boost your reportable assets.

FinAid | Financial Aid Applications | Maximizing Your Aid Eligibility

Or wait until after you've filed your last FAFSA, ahead of your child's senior year of college, to take distributions from a grandparent-owned asset, Meehan said. Asia Europe Stocks Commodities Currencies Bonds Funds ETFs Investing Trading Nation Trader Talk Financial Advisors Personal Finance Etf Street Portfolio Watchlist Stock Screener Fund Screener Tech Mobile Social Media Enterprise Gaming Cybersecurity Tech Guide Make It Entrepreneurs Leadership Careers Money Specials Shows Video Top Video Latest Video U.

Video Asia Video Europe Video CEO Interviews Analyst Interviews Full Episodes Shows Watch Live CNBC U. Business Day CNBC U. Primetime CNBC Asia-Pacific CNBC Europe CNBC World Full Episodes.

How Student and Parent Assets Affect Your Financial Aid - COLLEGEdata - Pay Your Way

Log In Register Log Out News Economy Finance Health Care Real Estate Wealth Autos Consumer Earnings Energy Life Media Politics Retail Commentary Special Reports Asia Europe CFO Council. Asia Europe Stocks Commodities Currencies Bonds Funds ETFs. Make It Entrepreneurs Leadership Careers Money Specials Shows Investing Trading Nation Trader Talk Financial Advisors Personal Finance Etf Street Portfolio Watchlist Stock Screener Fund Screener.

Tech Mobile Social Media Enterprise Gaming Cybersecurity Tech Guide Video Top Video Latest Video U. Video Asia Video Europe Video CEO Interviews Analyst Interviews Full Episodes. Primetime CNBC Asia-Pacific CNBC Europe CNBC World Special Reports Top States Paris Airshow Trailblazers Trading the World CNBC Disruptor 50 Lasting Legacy Modern Medicine College Game Plan Investing in: Israel Tech Drivers The Brave Ones Trading Nation Shaping the future Future Opportunities.

Register Log In Profile Email Preferences PRO Sign Out. Get your finances ready for the FAFSA Kelli B. Shelter your kid's money. Grant Personal Finance and Consumer Spending Reporter.