Digital put call parity

Forbidden

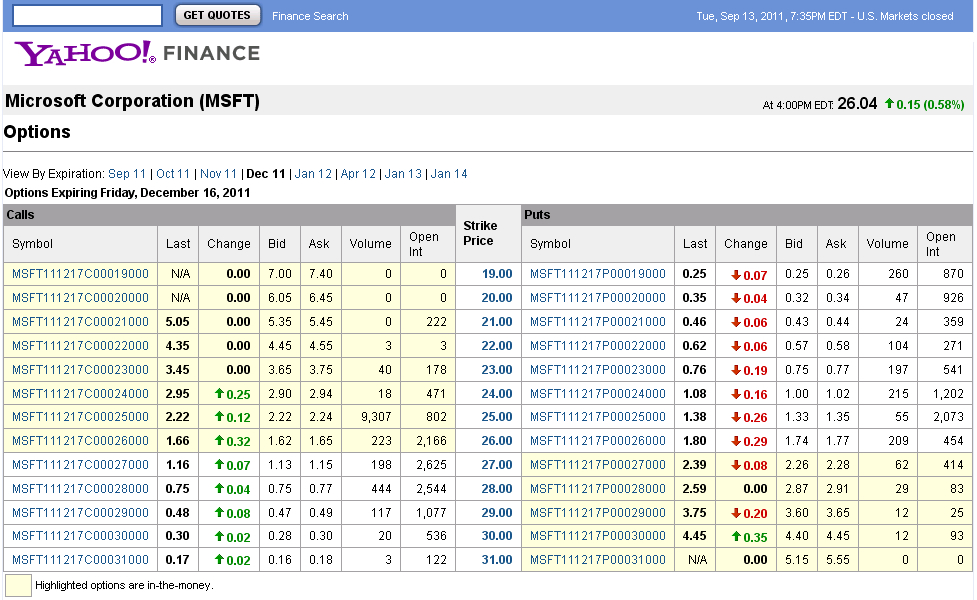

Put-call parity states that simultaneously holding a short European put and long European call of the same class will deliver the same return as holding one forward contract on the same underlying asset, with the same expiration and a forward price equal to the option's strike price. If the prices of the put and call options diverge so that this relationship does not hold, an arbitrage opportunity exists, meaning that sophisticated traders can earn a theoretically risk-free profit.

Put-call paritySuch opportunities are uncommon and short-lived in liquid markets. Put-call parity applies only to European options, which can only be exercised on the expiration date, and not American ones, which can be exercised before. Say that you purchase a European call option for TCKR stock.

Say you also sell or "write" or "short" a European put option for TCKR stock. The expiration date, strike price and cost of the option are the same. The buyer has purchased the right, but not the obligation, to sell you TCKR stock at the strike price; you are obligated to take that deal, whatever TCKR's market share price.

Binary option - Wikipedia

The profit or loss on these positions for different TCKR stock prices is graphed below. If they are going for more, you gain. Again, this scenario ignores all transaction fees. Another way to imagine put-call parity is to compare the performance of a protective put and a fiduciary call of the same class.

Binary option - Wilmott Wiki

A protective put is a long stock position combined with a long put, which acts to limit the downside of holding the stock. A fiduciary call is a long call combined with cash equal to the present value adjusted for the discount rate of the strike price; this ensures the investor has enough cash to exercise the option on the expiration date.

They are not, however, and the prices of European put and call options are ultimately governed by put-call parity. In a theoretical, perfectly efficient market, the prices for European put and call options would be governed by the equation:.

Let's continue to ignore transaction fees and assume that TCKR doesn't pay a dividend.

This makes intuitive sense: Let's say this is not the case, though: You can "sell" the more expensive side of the equation and buy the cheaper side to make, for all intents and purposes, a risk-free profit. In practice, this means selling a put, shorting the stock, buying a call and buying the risk-free asset TIPS , for example.

In reality, opportunities for arbitrage are short-lived and difficult to find. In addition, the margins they offer may be so thin that an enormous amount of capital is required to take advantage of them.

Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Put On A Call Call On A Call Expiration Date Derivatives In The Money Reverse Conversion Strike Price Covered Combination Put-Call Ratio American Option. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Put-call parity (video) | Khan Academy

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.