Put option definition example

As you become more informed about the options market, you will need to learn how to use a long or short position in either a rising or falling market.

Going long on a call is a profitable strategy when the underlying stock price rises in value, but how can you make money on a falling stock? By going long on a put. Puts are essentially the opposite of calls and have different payoff diagrams. Read on to find out how they work - and how you can profit. For more information on the long position, see Going Long On Calls. Going long on puts should not be confused with the technique of married puts.

Married puts are for protecting shares from a sharp decline in value with the purchase of puts on those shares. For additional reading, see Married Puts: A Protective Relationship and Cut Down Risk With Covered Calls.

Here, we focus on buying puts as a means to speculate on falling share prices. The major difference is that there is no ownership in the underlying shares - the only ownership is in the puts. Opening such a long position in your brokerage account involves " buying to open " a put position. Brokers use this confusing terminology because when you buy puts, you can be buying them either to open a position or to close a position.

Opening a position is self-explanatory, but closing a position simply means that you are buying back puts that you had sold earlier. To continue reading on calls, see Naked Call Writing and To Limit or Go Naked, That Is the Question. Besides buying puts, another common strategy used to profit from falling share prices is selling the stock short.

You do this by borrowing the shares from your broker and then selling them. If the price falls, you buy them back at a cheaper price and return them to the owner while keeping the profit. Buying puts instead of shorting is advantageous for the same reasons that buying calls is more advantageous than buying stocks. In addition to leverage , you also get the ability to buy puts on stocks for which you cannot find the shares to short.

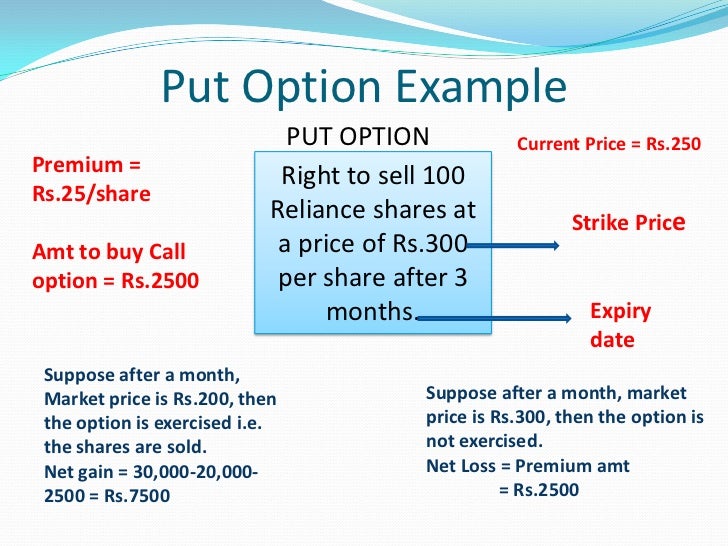

Put Option

Some stocks on the New York Stock Exchange NYSE or Nasdaq cannot be shorted because your broker does not have enough shares to lend to people who would like to short them. In such a case, puts become very useful because you can profit from the downside of a "non-shortable" stock. In addition, because the most you can lose is your premium , puts are inherently less risky than shorting a stock. To learn more about this concept, see Reducing Risk With Options. The distinction between a put and a call payoff diagram is important to remember.

When dealing with long calls, the profits you might obtain are limitless, because a stock can go up in value forever in theory. Puts are a very useful way profit from a fall in stock price. Such a position has inherent advantages over shorting a stock, but investors must be careful not to over-leverage their positions. If used properly, puts are an excellent way to profit from downside because your losses are limited to your option premium.

To continue reading about puts, see When does one sell a put, and when does one sell a call?

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

By Investopedia Staff Share. Put Your Money Where Your Mouth Is Going long on puts should not be confused with the technique of married puts.

Practical Considerations Besides buying puts, another common strategy used to profit from falling share prices is selling the stock short. To Put Or Not to Put Puts are a very useful way profit from a fall in stock price. Learn how put options can act as insurance for volatile stocks in your portfolio. As long as the underlying stocks are of companies you are happy to own, put selling can be a lucrative strategy. All investors should be aware that the best time to buy stocks is when the market is tanking, according to history.

This strategy allows you to stop chasing losses when you're feeling bearish. Learn about this aggressive trading strategy to generate income as part of a diversified portfolio. A brief overview of how to profit from using put options in your portfolio. Learn about a strategy that may be appropriate if you have a positive outlook on a stock. Selling a put option is a prudent way to generate additional portfolio income and gain exposure to desired stocks while limiting your capital investment.

Learn how sold puts can be utilized in different types of hedging strategies, and understand some of the more common option Learn how traders use put options in their trading strategies to remain profitable, even in a bear market.

Learn what risks to consider before taking a short put position. Shorting puts is a great strategy to earn income in certain Discover the main ways to take advantage of a fall in bank stocks. Shorting stocks and buying put options can let traders Learn about put options, considerations to make before you select strike prices and how to select strike prices for your An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

Put Options Explained | Ally

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.