Oversold overbought forex indicators

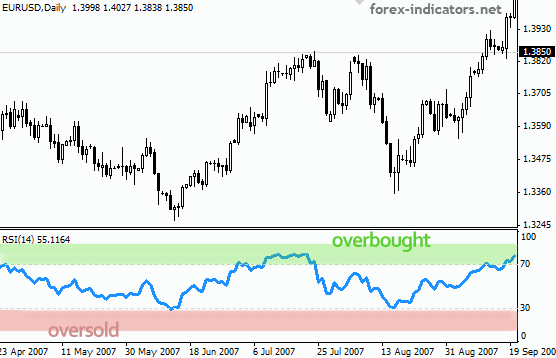

Basically, there are two types of momentum oscillators: Bound oscillators, such as RSI and the Stochastic Oscillator, fluctuate within a specific range, zero to one hundred in this case.

Unbound oscillators, such as MACD and Rate-of-Change, do not have upper and lower limits. Click this image for a live chart The example above shows Gilead GILD with 5-period RSI in the first indicator window.

I am using 5-period RSI instead of period RSI because the shorter timeframe makes it more sensitive and it generates more signals. RSI is deemed overbought when above 70 and oversold when below Chartists should keep two things in mind when looking for signals.

First, identify the trend. Notice that the trend was up from September to February and there were far more overbought readings than oversold readings.

RSI As A Great Overbought Oversold Indicator For Forex Trading

Selling on overbought readings would have been a losing strategy. It is best to focus on oversold readings during an uptrend and overbought readings during a downtrend.

Second, wait for a signal that the pullback has ended.

What are the best indicators to identify overbought and oversold stocks? | Investopedia

An oversold reading occurs during a pullback, but pullbacks sometimes extend further than expected. The early March oversold reading is a case-in-point.

Interpreting Overbought and Oversold

Chartists, therefore, should look for some sign that the pullback is ending and the bigger trend is resuming. An RSI move above 50 is one such trigger green dotted lines. The information provided by StockCharts. Trading and investing in financial markets involves risk.

You are responsible for your own investment decisions. Before investing based on this information, carefully read our Terms of Service. All StockCharts Blogs All StockCharts Blogs ChartWatchers Commodities Countdown Dancing with the Trend DecisionPoint Don't Ignore This Chart RRG Charts The Canadian Technician The Traders Journal Top Advisors Corner Trading Places with Tom Bowley Wyckoff Power Charting MEMBERS-ONLY BLOGS John Murphy's Market Message Art's Charts DecisionPoint Alert DecisionPoint Reports Martin Pring's Market Roundup.

Commentary John Murphy Martin Pring Arthur Hill DecisionPoint Webinars. Additional Resources Store Members Terms of Service Privacy Statement Site Map. Click here to see the live version. MailBag Which Indicators Can I use to Define Overbought and Oversold?

Arthur Hill March 28, at Subscribe to MailBag to be notified whenever a new post is added to this blog! Free Charts ChartSchool Blogs Webinars Members FAQ Support Glossary Privacy Statement.